TN (Trade NAFTA) status is a special non-immigrant status in the United States unique to citizens of Canada and Mexico. Beginning in 1988, individuals practicing one of the professions identified in the Canada – United States Free Trade Agreement are able to obtain TN status for legal work in the United States and Canada, creating freedom of labor movement.

TN status is recognized in the North American Free Trade Agreement (NAFTA) which began in 1994. It allows U.S., Canadian and Mexican citizens the opportunity to work in each other’s countries in certain professional occupations.

It bears a similarity, in some ways, to the H-1B visa, but also has many unique features. Within the TN set of occupations, an American, Canadian or Mexican can work for up to three years (until October 16, 2008, one year) at a time.

However, the TN status may be renewed indefinitely in three-year increments, although it is not a ‘permanent’ or immigrant visa and if US immigration officials suspect it is being used as a de facto green card, they may elect to deny further renewals.

The set of occupations permitted to petition for TN status is also quite a bit more limited than for the H-1B visa.[2]

Spouse and dependent children of a TN professional can be admitted into the United States in the TN status.

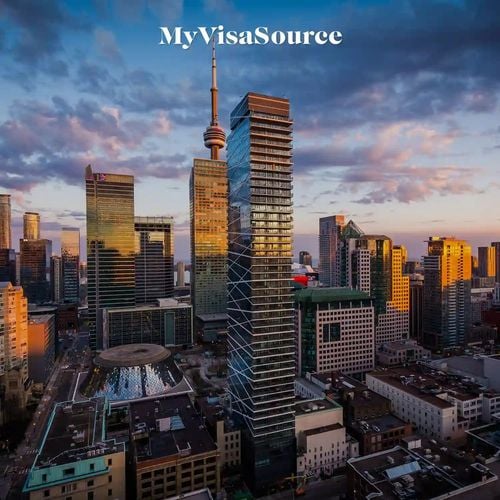

Canadian Citizens Working in the United States

Canadian professionals are admitted into the USA in the TN-1 status. Applying for this status is a fairly streamlined procedure and an immigration lawyer with experience in this area could help you with this TN Visa process.

The Canadian must first obtain proof of a job offer, in the form of an employment letter detailing employment for not more than three years, and documentation (often in the form of a university degree and/or evidence of former employment) in the occupation area.

This paperwork is then brought to the border (most commonly it is done upon entry to the USA from Canada, but entry in TN status is permitted at any port of entry), along with proof of Canadian citizenship and the $50 fee (plus an additional $6 at a land or sea crossing; this is included in airline tickets when arriving by air).

The US immigration officer will then adjudicate the application on the spot and grant or deny TN status. If the decision is to grant TN status, the Canadian immediately enters the US and begins TN employment.

If the decision is to deny, the immigration officer will often detail the shortcomings in the application; if these are relatively straightforward to correct, the Canadian will often correct the problem in a day or so and then return to the border to reapply.

Certain TN status categories are known to be more difficult than others. For example, ‘Management Consultant’ applicants will often be scrutinized closely to determine if they will really be serving as consultants, or are in practice simply ‘managers’. (The latter is generally not allowed under TN status.)

Similarly, ‘Computer Systems Analysts’ will often have their applications carefully examined to ensure that their qualifications and job duties truly rise to the level of Computer Systems Analyst, and that they are not in practice simply serving as computer programmers.

Once TN status is granted, it is good for three years, but only for the specific employer for which it was originally requested. Changing employers will require the Canadian to return to the border and start from scratch with a new application.

If employment with a single employer is desired for more than three years, it may be renewed indefinitely. Renewal is accomplished either by a mail-in renewal within the United States, or by returning to the border and, in effect, presenting a new application.

Renewal is possible, in theory, indefinitely, but the TN status is not a substitute for permanent residency (a green card), and the border official has the discretion to refuse further renewals if she feels the ability for indefinite renewal is being abused. How this happens in practice depends largely on the mood of the individual border official.

Some Canadians have successfully renewed TN status for a decade or more; others have found that after 3–4 years a border official denies further renewals.

Canadian citizenship for TN status purposes may be by descent or naturalization. Those with qualifications from sources outside Canada or the U.S. must prove equivalency to the U.S. requirements. There is no appeal recourse if one is refused TN status.

Tax Requirements of Canadians Working in the US

Canadian TN status workers appear to be responsible for US Medicare, State, Federal and Social Security taxes whether they are resident or non-resident (working remotely) in the U.S.

If their legal residence is still in Canada, workers are also required to file Provincial and Federal income tax but can credit some part of the taxes paid in the United States.

Bilateral treaties exist to allow workers to regain benefits. For example, years worked in the U.S. may contribute to the Canada Pension Plan and Old Age Security eligibility with the proper paperwork.